AeroStep

-

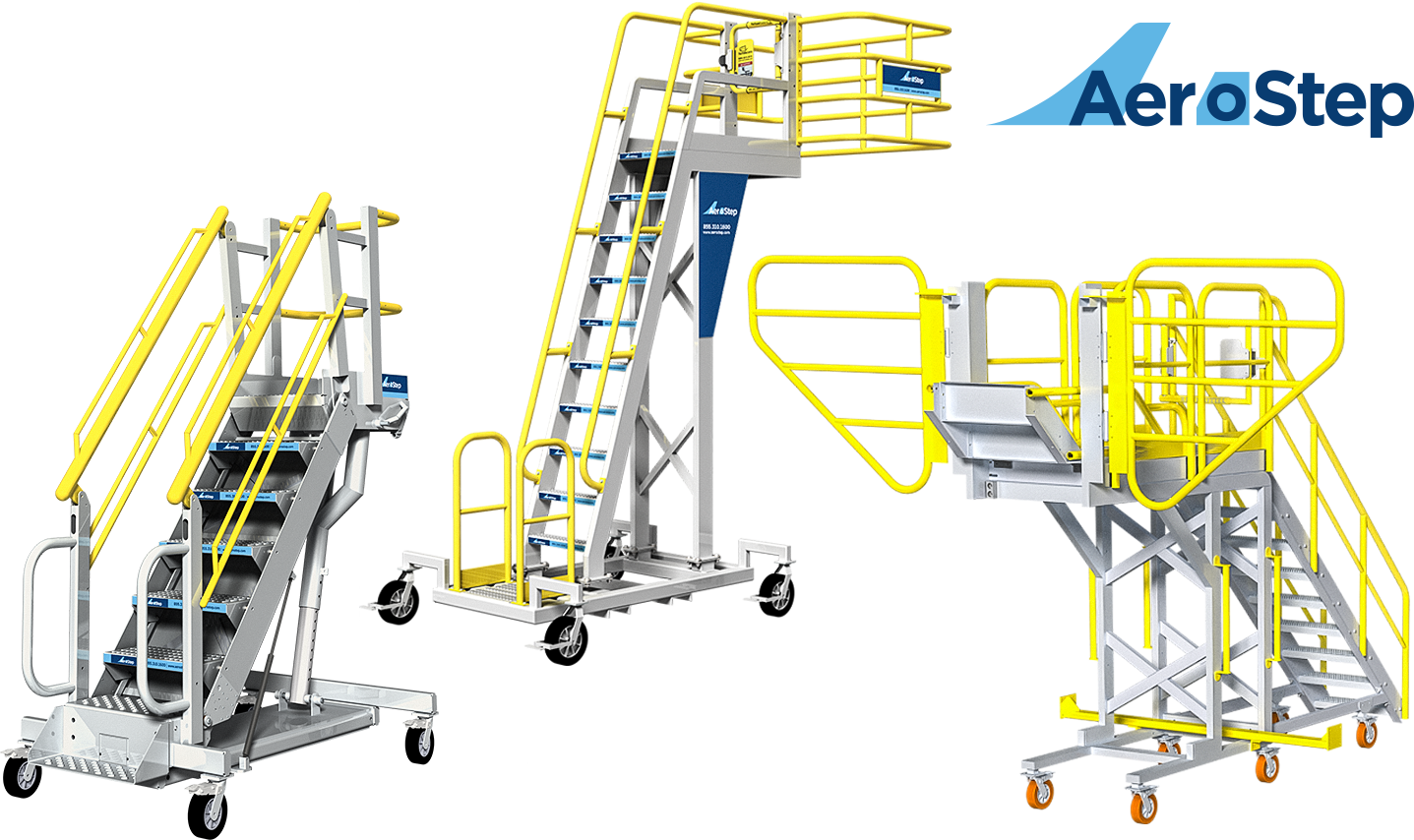

SafeRack Introduces AeroStep, Mobile Stair Units for Aviation and Aerospace

SafeRack, the leading manufacturer of truck and railcar loading platforms and safety equipment, is excited to announce AeroStep, a specialized line of rolling stairs and access platforms for aerospace and aviation industries. AeroStep’s mobile stairs have the stability of a fixed platform, but are highly mobile and can be precisely positioned against even the most…

-

Falfurrias Capital Announces Strategic Investment in SixAxis

Falfurrias Capital Announces Strategic Investment in SixAxis SixAxis is a leading manufacturer of safety equipment, including SafeRack, ErectaStep brands CHARLOTTE, N.C. (Sept. 21, 2017) – Falfurrias Capital Partners (“FCP”), a Charlotte-based private equity firm focused on investing in growth-oriented, middle-market businesses, and SixAxis LLC (“SixAxis”), the leading manufacturer of advanced products that increase worker…

-

SixAxis Statement Regarding Hurricane Harvey

On behalf of the entire SixAxis family, our thoughts and prayers go out to all of those impacted by this devastating storm. We know for certain that many of our employees, dealers, and customers in the area have sustained significant damage and hardship as a result of this historical disaster. SixAxis is contributing $5,000 to…

-

New ways of thinking lead to opportunity and growth

By Andrel S. Langely SafeRack co-founders Fred Harmon and Rob Honeycutt stand in front of the global company’s 225,000-square-foot facility in Andrews, S.C. Not seeing any virtue in simply doing things the way they’ve always been done has led to grand things for SafeRack co-founders Rob Honeycutt and Fred Harmon. SafeRack started in 2003 when…

-

SafeRack LLC named supplier of choice for Holcim (US) and Lafarge North America Inc. plant and term

Holcim (US) and Lafarge North America Inc., US businesses of LafargeHolcim Ltd, One of the world’s leading suppliers of cement, aggregates, concrete and asphalt, have announced that they have selected SafeRack to be their exclusive provider of trailer loading gangways, platforms, and safety related loaded equipment for the entire US marketplace. Two months of joint…

-

About the buying experience

How one manufacturer streamlined quoting and grew 500 percent in six years. Metal fabricators have a history of growing through word-of-mouth. Many companies go for years, sometimes generations, without hiring a single salesperson. It’s just the nature of this manufacturing sector dominated by small, multigenerational family shops. Few say their company is “sales-driven.”

-

A South Carolina Startup That Hacked The Industrial Process To Reach $100 Million In Revenue

As seen on Forbes.com By Christopher Steiner Rob Honeycutt’s success defies so many conventions within the entrepreneurial canon that it’s hard to pick which part of his tale merits telling first. As a salesman, he’s not supposed to be good with software. As somebody without a college degree, he’s not supposed to be able to, in a…